URA Rolls out Digital Strategy to Improve Tax Compliance

URA launched its three-year digital strategy in partnership with the United Nations Development Programme aimed at integrating technology in tax administration. The strategy will facilitate URA‘s agenda of automating tax processes, quality assurance and mitigating revenue leakages. The strategy also presents an overarching objective of client centrism to allow taxpayers to comply with their obligations in terms of tax registration, on-time filing, payment and accurate reporting.

Speaking at the launch of the strategy in Nakawa on Friday, Matia Kasaija, the Minister of Finance, Planning and Economic Development pledged his support towards URA‘s digital transformation journey. He, however, challenged the URA team to push up the country’s tax-to-GDP ratio to 20% in the next 2-3 years despite a slight increase of 14%.

“I am tired of borrowing, please save me from the humiliation of getting money that has strings attached. We need revenue to create valuable jobs for our youth, support industries, and build schools, hospitals and other infrastructure,” Kasaija said of URA‘s task ahead.

The Commissioner General, John R. Musinguzi on the other hand promised that with the progressive journey in information technology innovations, URA will continue adding value to its mission of mobilizing revenue for National development in a transparent and efficient manner, by digitizing its processes. “Technology is the future to handling revenue effectively,it increases transparency and minimizes the conflicts around tax compliance.”

He explained that URA has earmarked 5 areas that will help the government generate enough revenue. These included digitizing all URA processes to make them efficient and transparent, ensuring all URA staff serve with integrity and professionalism, stakeholder engagement and tax sensitization plus investing in innovation and research for improved data.

Musinguzi also narrated how the I.T. transformational journey started in 2009 with acquired systems like Etax for domestic taxes and Asycuda for international trade in customs. He added that this year is a new phase of simplifying taxation and big data analytics through the fully-fledged data centre.

He thanked the Government of Uganda for always investing in the ICT sector which has helped in transforming of not only tax processes but increased URA interaction with her stakeholders. “I want to assure you that every money you entrust us with, will be well spent on machine learning technologies and digitizing systems. For now, we have the number one data centre in this country and have acquired a number of technologies through reduced costs,” Musinguzi boasted.

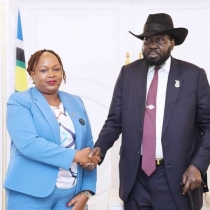

Sheila Ngatia, the Deputy Resident Representative of the United Nations Development Programme, congratulated URA and said that the digital strategy was in line with the government‘s digital agenda that focuses on five key pillars: skills development, digital services, cybersecurity, innovation and entrepreneurship, and the necessary enabling environment and infrastructure.

“I am glad that the URA digital strategy will focus on increasing efficiency as well as leverage on ICT to enhance operations and improve capability in mitigating revenue leakages,” she said of the URA digital strategy. She encouraged URA to invest in robust cyber security and ensure that all Ugandans are empowered to enjoy the efforts of a digitalized economy.

At the launch, Robert Mutebi, the Commissioner of Information Technology & Innovation noted that Digital transformation is a critical component towards improving tax administration, especially in terms of efficiency, speed-to-serve and capacity to draw insights from the big data flows in different formats from taxpayers.

Meanwhile, URA has since rolled out a number of solutions to ease compliance of taxpayers and their interaction with URA. These include the Electronic Receipting and Invoicing System (EFRIS) for e-filing and e-invoicing, Digital Tax stamping (DTS) for manufacturers, Customer Relationship Management tools, Non-intrusive inspection with scanners at the customs borders, Bond Warehouse management system, Rental Tax Income Management solutions, a Call centre that serves through multiple touchpoints (WhatsApp, web, email)and several taxpayer interface enhancements like the web portal, the Mobile App and the new USSD menu.

Links

- 58 views

Join the conversation